-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

In CFD trading, having solid strategies is essential for long-term success. Without a structured plan, trading can be like sailing without a compass. Weekly planning provides direction and focus, helping traders manage risks and adapt to market changes. It’s not just an administrative task but a strategic exercise that enhances trading skills and decision-making. This framework fosters informed decisions and disciplined risk management for traders.

* Effective weekly planning can greatly impact a CFD trader’s ability to handle market volatility.

* The choice of a CFD trading platform and broker plays a pivotal role in a trader’s strategy.

* A well-structured trading plan helps in making informed decisions for long-term profitability.

* Adopting a disciplined approach is key to achieving consistency in trading outcomes.

* Strategic planning is essential for managing risks and maximising trading opportunities.

As a trader, dealing with market volatility is an inevitable part of the job. It’s not enough to simply recognize that the markets are volatile; successful volatility trading requires strategies that can filter through the noise and find opportunities. Among these, volatility trading strategies that use specific indicators are vital tools for any trader’s arsenal. These indicators are tailored to highlight market conditions conducive to entering and exiting positions and are an essential aspect of any volatility trading system.

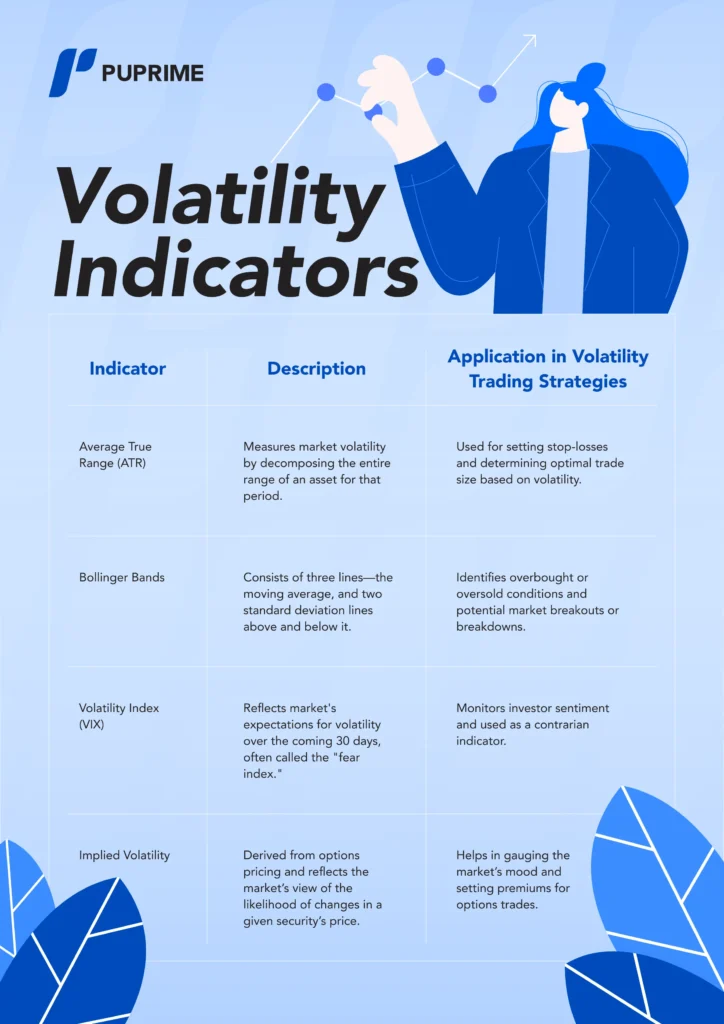

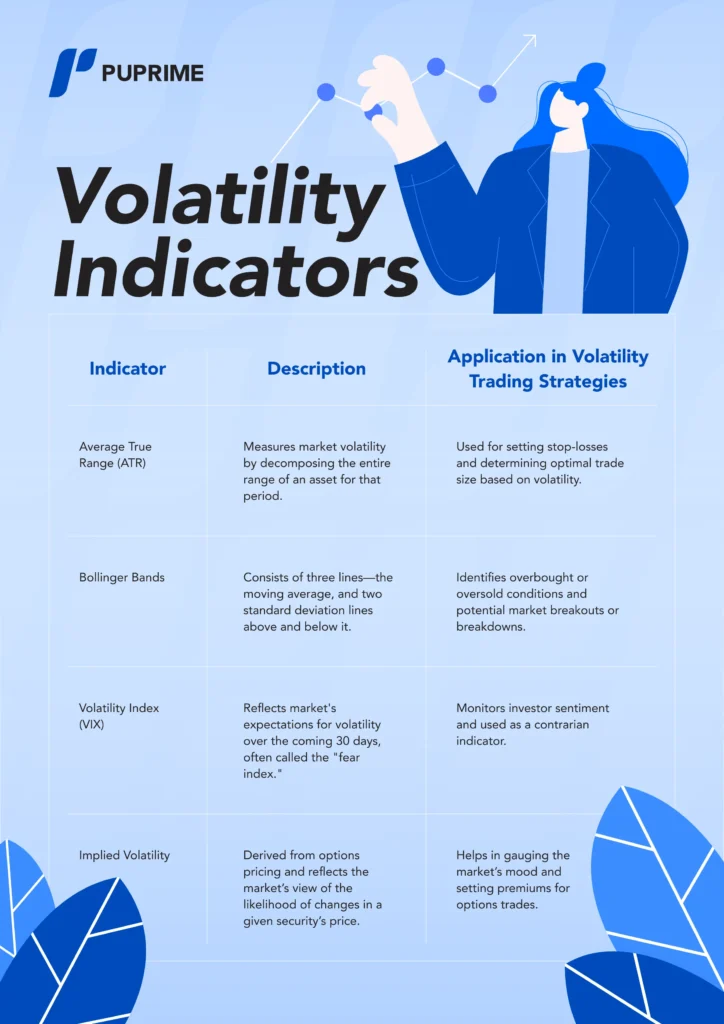

Understanding and utilizing volatility indicators is essential to navigate through market volatility. These indicators serve as a compass in the often chaotic financial markets, helping traders discern the extent of market volatility and potentially predict future market movements. Below is a table of commonly used volatility indicators and a brief overview of how they can be incorporated into a trading plan.

These indicators provide traders with a framework for analyzing market volatility, enabling them to time their trades more effectively. By understanding how to use these tools within volatility trading strategies, traders can mitigate risks and position themselves to take advantage of market movements. The key is to apply these indicators in the context of a comprehensive trading plan that allows for flexibility in the face of ever-changing market conditions.

Understand The Basics Of Technical Analysis

Find out more here

Understanding current market conditions is crucial for traders who strive to make data-driven decisions. Moving averages serve as pivotal instruments to smooth out price data and discern the direction of market trends. Furthermore, staying abreast of the latest market events is key to adjusting strategies in real-time.

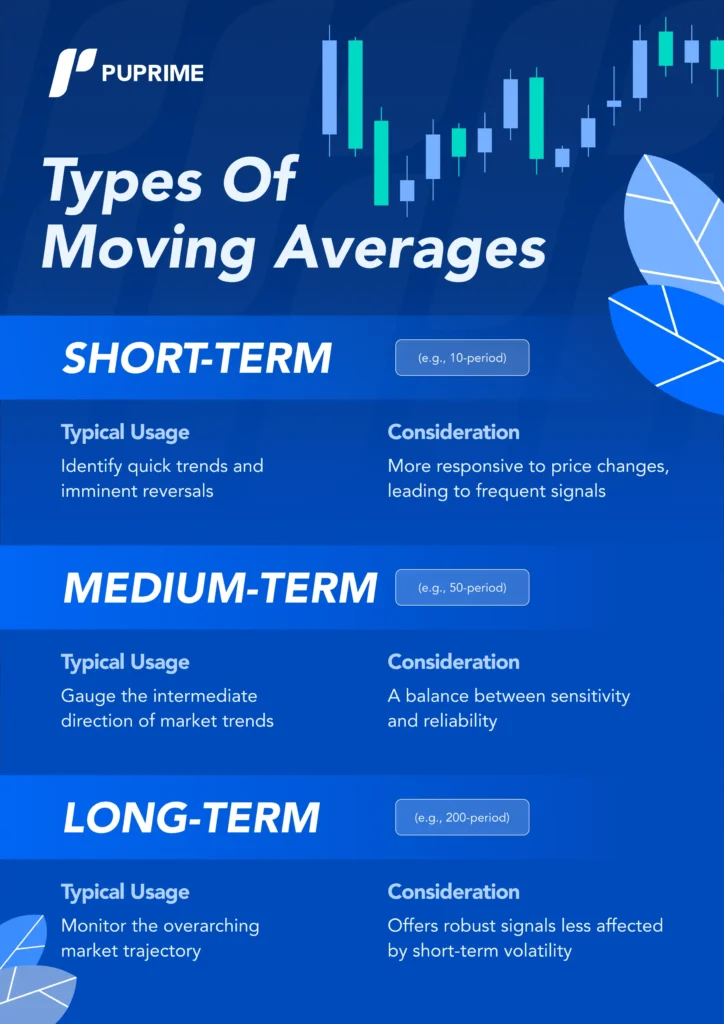

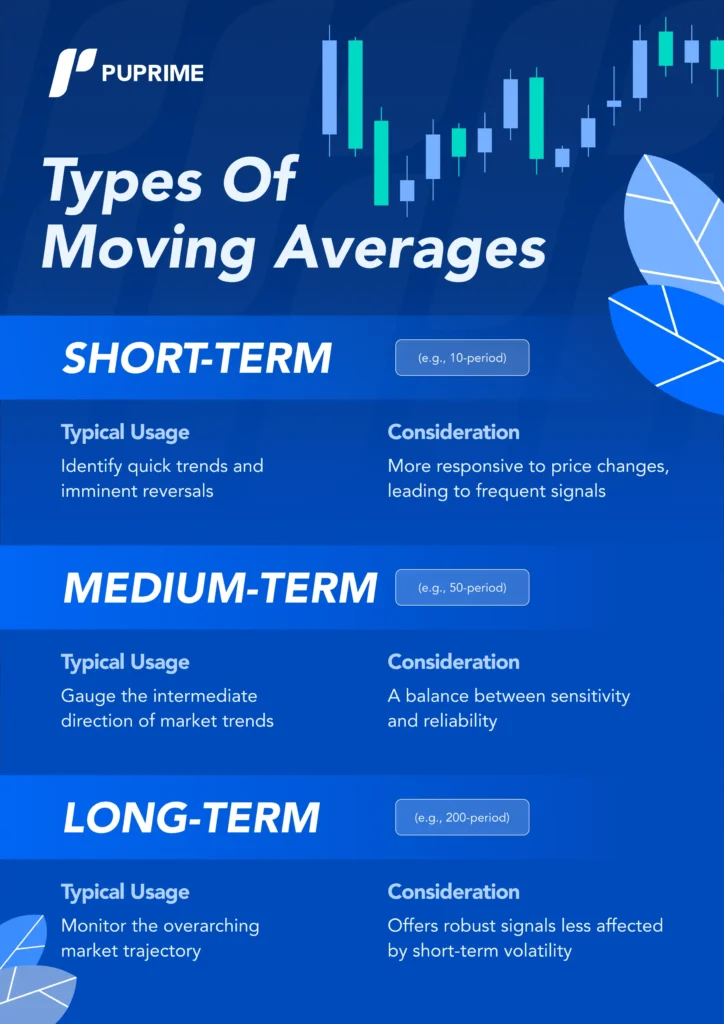

Integrating moving averages into one’s trading toolkit can significantly aid in highlighting the trends amidst the market’s noise. By calculating the average asset price over a set period, moving averages offer clear signals that can help determine momentum and potential points of entry and exit. Let’s consider the significance of commonly employed moving averages:

The importance of staying informed about the latest market events cannot be overstated. Economic announcements, policy changes, and significant geopolitical events can all create substantial ripples throughout financial markets. By keeping a finger on the pulse of these developments, traders can anticipate volatility spikes or shifts in market sentiment, positioning themselves accordingly. Whether through economic calendars, news aggregators or financial analysis, staying informed equips traders with a broader awareness essential for adaptive trading strategies.

Understand What Is Fundamental Analysis

Find out more here

For investors navigating the complex financial markets, the decision to choose what to trade is pivotal to success. Every market offers a unique array of instruments, and the trade selection process should be underpinned by a robust market analysis to pinpoint where opportunity aligns with risk. Whether one targets currency pairs in the forex arena, the latest tech stocks on the NASDAQ, or precious commodities like gold and oil, dissecting the market’s fabric is a vital step.

Determining trade selection revolves around understanding market dynamics and one’s individual trading goals. For instance, traders with a keen interest in currency markets might focus on establishing which are the best currency pairs to trade. This hinges on analyzing historical price movements, current economic events, and relative volatility. Meanwhile, stock traders take cues from company performance metrics, earnings reports, and the broader state of the industry before taking a position.

Ultimately, the intersection of a trader’s expertise, risk profile, and the current state of the market guides the trade selection process. One size does not fit all; careful consideration of the factors at play ensures that traders are not just following the crowd, but crafting a strategy tailored to their aspirations and the market’s reality.

Understand What Are The Most Volatile Currency Pairs And How To Trade Them

Find out more here

The bedrock of sustained success in the trading world hinges on the implementation of robust risk management strategies. Effective risk mitigation forms the backbone of a trader’s arsenal, allowing for the careful navigation through the tumultuous waters of the financial markets. It is imperative that traders establish a clear understanding of their individual risk tolerance to devise a strategy that aligns with their specific trading goals and comfort levels.

One of the cornerstones of risk management is the judicious use of stop-loss orders. A stop-loss order acts as a critical safeguard, an automated instruction to sell a security when it reaches a particular price point, thus curtailing potential losses. While no approach is infallible, incorporating stop-loss orders can significantly aid in preserving a trader’s capital.

In addition to using stop-loss orders, smart position sizing is crucial. This involves deciding how much of your total trading capital to invest in each trade, based on market conditions and your risk tolerance. Position sizing is a practical way to manage risk effectively. Also, traders should determine their risk tolerance before entering any trades.

Understand The Basics Of Risk Management In Trading

Find out more here

Planning trades carefully and executing them accurately is essential for success in the financial markets. Effective trade planning means creating clear entry and exit strategies based on specific conditions. Disciplined execution ensures these strategies are followed precisely, reducing the impact of emotional decisions.

* Entry Strategies: Pinpointing the perfect moment to enter a trade requires an acute understanding of market behaviors. Entry strategies must align with a trader’s overall market analysis and trade planning to achieve the anticipated outcome.

* Exit Strategies: A clearly defined exit strategy is critical for both locking in profits and minimizing losses. Trade exit strategies must be considered as part of the initial trade planning to avoid emotional decision-making during trade execution.

Moreover, trade objectives set the course for how trade should progress. They are the benchmarks against which traders measure the performance of their actions. Lastly, the risk-reward ratio helps in maintaining a balance between the potential profit of a trade and the risk undertaken. Establishing a clear risk-reward threshold as part of the trade planning process is imperative for long-term portfolio health.

Thorough trade planning and disciplined execution are key to a trader’s success. By consistently using entry and exit strategies, staying focused on trade goals, and sticking to predetermined risk-reward ratios, traders can navigate the financial markets confidently.

Effective trading hinges not only on one’s strategy and insight but also heavily on the utility of various trading tools. For those involved in CFD trading, making savvy decisions requires an arsenal of technical analysis tools and fundamental analysis tools. These instruments aid traders in dissecting market trends, economic data, and chart patterns to make informed predictions and execute profitable trades.

In the realm of technical analysis tools, traders are spoilt for choice with a plethora of indicators at their disposal. Technical indicators such as moving averages, Bollinger Bands, and the MACD (Moving Average Convergence Divergence) are staples for technical traders, helping them identify potential entry and exit points within the markets.

On the flip side, no comprehensive trading strategy is complete without incorporating fundamental analysis tools. Traders utilize economic calendars, earnings reports, and the latest financial news to grasp the broader economic landscape. Platforms like Bloomberg and Reuters provide real-time data and news updates, crucial for CFD traders who need to stay ahead of market-moving events that can dramatically affect their open positions.

Adopting a mix of these trading tools can dramatically enhance a CFD trader’s ability to make calculated decisions. A dynamic approach, utilizing both technical and fundamental perspectives, permits a holistic analysis of market conditions, ultimately fostering a well-rounded trading strategy.

To achieve success in the dynamic realm of trading, it is imperative that traders consistently refine trading strategies based on careful trade performance analysis. This continuous cycle of evaluation and adaptation is the cornerstone of maintaining an edge in the financial markets. By dissecting past trades, market participants can identify winning techniques and discern patterns that lead to losses, thereby informing future strategy adjustments.

Trade performance analysis is not just about numbers; trading psychology plays a pivotal role as well. Understanding the psychological factors that influenced decisions during trades can provide invaluable insights. It can inform traders when emotions like fear or greed might be skewing their decision-making processes and can lead to deploying more objective, systematic approaches to trading.

Developing a strong trading psychology is crucial for refining strategies. Trading can be isolated, and it requires mental resilience. Controlling emotions helps traders stick to their strategy instead of reacting impulsively to market changes out of fear.

The evolution of a trading strategy is not a one-time event but an ongoing process that demands dedication and a willingness to learn. By committing to a regular trade performance analysis and nurturing robust trading psychology, traders can adapt to changing market conditions and refine their approaches, leading toward greater consistency and potential profitability in their trading endeavors.

Successful CFD trading relies on meticulous weekly planning and a strong trading mindset. Weekly planning helps traders anticipate market movements and leverage volatility to their advantage. Setting realistic goals, continuous learning, and adapting to market changes are key tips for success. Discipline, patience, and resilience are essential for maintaining a successful trading mindset. By integrating knowledge, strategic planning, and psychological fortitude, traders can aim for consistent performance and long-term success. Ultimately, the combination of careful weekly planning and a resilient mindset is the essence of trading excellence.

Open A Live Account And Start Trading

Create Live Account

CFD traders profit from the difference between the entry and exit prices of their contracts. If the price of the underlying asset moves in the direction predicted by the trader, they make a profit. Conversely, if the price moves against their position, they incur a loss.

The most volatile CFD to trade can vary depending on market conditions and specific events. However, some commonly traded volatile CFDs include those based on indices, commodities like crude oil or gold, and individual stocks known for significant price fluctuations.

CFD trading can be challenging due to factors such as market volatility, leverage, and the need for disciplined risk management. Additionally, traders must contend with emotions such as fear and greed, which can influence decision-making and lead to losses if not managed effectively.

The decision to trade CFDs or stocks depends on individual preferences, risk tolerance, and trading goals. CFDs offer advantages such as leverage and the ability to profit from both rising and falling markets, while stock trading provides ownership in a company and potential dividends. It’s essential to research both options and consider factors like market conditions and personal financial situation before deciding which to trade.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

In CFD trading, having solid strategies is essential for long-term success. Without a structured plan, trading can be like sailing without a compass. Weekly planning provides direction and focus, helping traders manage risks and adapt to market changes. It’s not just an administrative task but a strategic exercise that enhances trading skills and decision-making. This framework fosters informed decisions and disciplined risk management for traders.

* Effective weekly planning can greatly impact a CFD trader’s ability to handle market volatility.

* The choice of a CFD trading platform and broker plays a pivotal role in a trader’s strategy.

* A well-structured trading plan helps in making informed decisions for long-term profitability.

* Adopting a disciplined approach is key to achieving consistency in trading outcomes.

* Strategic planning is essential for managing risks and maximising trading opportunities.

As a trader, dealing with market volatility is an inevitable part of the job. It’s not enough to simply recognize that the markets are volatile; successful volatility trading requires strategies that can filter through the noise and find opportunities. Among these, volatility trading strategies that use specific indicators are vital tools for any trader’s arsenal. These indicators are tailored to highlight market conditions conducive to entering and exiting positions and are an essential aspect of any volatility trading system.

Understanding and utilizing volatility indicators is essential to navigate through market volatility. These indicators serve as a compass in the often chaotic financial markets, helping traders discern the extent of market volatility and potentially predict future market movements. Below is a table of commonly used volatility indicators and a brief overview of how they can be incorporated into a trading plan.

These indicators provide traders with a framework for analyzing market volatility, enabling them to time their trades more effectively. By understanding how to use these tools within volatility trading strategies, traders can mitigate risks and position themselves to take advantage of market movements. The key is to apply these indicators in the context of a comprehensive trading plan that allows for flexibility in the face of ever-changing market conditions.

Understand The Basics Of Technical Analysis

Find out more here

Understanding current market conditions is crucial for traders who strive to make data-driven decisions. Moving averages serve as pivotal instruments to smooth out price data and discern the direction of market trends. Furthermore, staying abreast of the latest market events is key to adjusting strategies in real-time.

Integrating moving averages into one’s trading toolkit can significantly aid in highlighting the trends amidst the market’s noise. By calculating the average asset price over a set period, moving averages offer clear signals that can help determine momentum and potential points of entry and exit. Let’s consider the significance of commonly employed moving averages:

The importance of staying informed about the latest market events cannot be overstated. Economic announcements, policy changes, and significant geopolitical events can all create substantial ripples throughout financial markets. By keeping a finger on the pulse of these developments, traders can anticipate volatility spikes or shifts in market sentiment, positioning themselves accordingly. Whether through economic calendars, news aggregators or financial analysis, staying informed equips traders with a broader awareness essential for adaptive trading strategies.

Understand What Is Fundamental Analysis

Find out more here

For investors navigating the complex financial markets, the decision to choose what to trade is pivotal to success. Every market offers a unique array of instruments, and the trade selection process should be underpinned by a robust market analysis to pinpoint where opportunity aligns with risk. Whether one targets currency pairs in the forex arena, the latest tech stocks on the NASDAQ, or precious commodities like gold and oil, dissecting the market’s fabric is a vital step.

Determining trade selection revolves around understanding market dynamics and one’s individual trading goals. For instance, traders with a keen interest in currency markets might focus on establishing which are the best currency pairs to trade. This hinges on analyzing historical price movements, current economic events, and relative volatility. Meanwhile, stock traders take cues from company performance metrics, earnings reports, and the broader state of the industry before taking a position.

Ultimately, the intersection of a trader’s expertise, risk profile, and the current state of the market guides the trade selection process. One size does not fit all; careful consideration of the factors at play ensures that traders are not just following the crowd, but crafting a strategy tailored to their aspirations and the market’s reality.

Understand What Are The Most Volatile Currency Pairs And How To Trade Them

Find out more here

The bedrock of sustained success in the trading world hinges on the implementation of robust risk management strategies. Effective risk mitigation forms the backbone of a trader’s arsenal, allowing for the careful navigation through the tumultuous waters of the financial markets. It is imperative that traders establish a clear understanding of their individual risk tolerance to devise a strategy that aligns with their specific trading goals and comfort levels.

One of the cornerstones of risk management is the judicious use of stop-loss orders. A stop-loss order acts as a critical safeguard, an automated instruction to sell a security when it reaches a particular price point, thus curtailing potential losses. While no approach is infallible, incorporating stop-loss orders can significantly aid in preserving a trader’s capital.

In addition to using stop-loss orders, smart position sizing is crucial. This involves deciding how much of your total trading capital to invest in each trade, based on market conditions and your risk tolerance. Position sizing is a practical way to manage risk effectively. Also, traders should determine their risk tolerance before entering any trades.

Understand The Basics Of Risk Management In Trading

Find out more here

Planning trades carefully and executing them accurately is essential for success in the financial markets. Effective trade planning means creating clear entry and exit strategies based on specific conditions. Disciplined execution ensures these strategies are followed precisely, reducing the impact of emotional decisions.

* Entry Strategies: Pinpointing the perfect moment to enter a trade requires an acute understanding of market behaviors. Entry strategies must align with a trader’s overall market analysis and trade planning to achieve the anticipated outcome.

* Exit Strategies: A clearly defined exit strategy is critical for both locking in profits and minimizing losses. Trade exit strategies must be considered as part of the initial trade planning to avoid emotional decision-making during trade execution.

Moreover, trade objectives set the course for how trade should progress. They are the benchmarks against which traders measure the performance of their actions. Lastly, the risk-reward ratio helps in maintaining a balance between the potential profit of a trade and the risk undertaken. Establishing a clear risk-reward threshold as part of the trade planning process is imperative for long-term portfolio health.

Thorough trade planning and disciplined execution are key to a trader’s success. By consistently using entry and exit strategies, staying focused on trade goals, and sticking to predetermined risk-reward ratios, traders can navigate the financial markets confidently.

Effective trading hinges not only on one’s strategy and insight but also heavily on the utility of various trading tools. For those involved in CFD trading, making savvy decisions requires an arsenal of technical analysis tools and fundamental analysis tools. These instruments aid traders in dissecting market trends, economic data, and chart patterns to make informed predictions and execute profitable trades.

In the realm of technical analysis tools, traders are spoilt for choice with a plethora of indicators at their disposal. Technical indicators such as moving averages, Bollinger Bands, and the MACD (Moving Average Convergence Divergence) are staples for technical traders, helping them identify potential entry and exit points within the markets.

On the flip side, no comprehensive trading strategy is complete without incorporating fundamental analysis tools. Traders utilize economic calendars, earnings reports, and the latest financial news to grasp the broader economic landscape. Platforms like Bloomberg and Reuters provide real-time data and news updates, crucial for CFD traders who need to stay ahead of market-moving events that can dramatically affect their open positions.

Adopting a mix of these trading tools can dramatically enhance a CFD trader’s ability to make calculated decisions. A dynamic approach, utilizing both technical and fundamental perspectives, permits a holistic analysis of market conditions, ultimately fostering a well-rounded trading strategy.

To achieve success in the dynamic realm of trading, it is imperative that traders consistently refine trading strategies based on careful trade performance analysis. This continuous cycle of evaluation and adaptation is the cornerstone of maintaining an edge in the financial markets. By dissecting past trades, market participants can identify winning techniques and discern patterns that lead to losses, thereby informing future strategy adjustments.

Trade performance analysis is not just about numbers; trading psychology plays a pivotal role as well. Understanding the psychological factors that influenced decisions during trades can provide invaluable insights. It can inform traders when emotions like fear or greed might be skewing their decision-making processes and can lead to deploying more objective, systematic approaches to trading.

Developing a strong trading psychology is crucial for refining strategies. Trading can be isolated, and it requires mental resilience. Controlling emotions helps traders stick to their strategy instead of reacting impulsively to market changes out of fear.

The evolution of a trading strategy is not a one-time event but an ongoing process that demands dedication and a willingness to learn. By committing to a regular trade performance analysis and nurturing robust trading psychology, traders can adapt to changing market conditions and refine their approaches, leading toward greater consistency and potential profitability in their trading endeavors.

Successful CFD trading relies on meticulous weekly planning and a strong trading mindset. Weekly planning helps traders anticipate market movements and leverage volatility to their advantage. Setting realistic goals, continuous learning, and adapting to market changes are key tips for success. Discipline, patience, and resilience are essential for maintaining a successful trading mindset. By integrating knowledge, strategic planning, and psychological fortitude, traders can aim for consistent performance and long-term success. Ultimately, the combination of careful weekly planning and a resilient mindset is the essence of trading excellence.

Open A Live Account And Start Trading

Create Live Account

CFD traders profit from the difference between the entry and exit prices of their contracts. If the price of the underlying asset moves in the direction predicted by the trader, they make a profit. Conversely, if the price moves against their position, they incur a loss.

The most volatile CFD to trade can vary depending on market conditions and specific events. However, some commonly traded volatile CFDs include those based on indices, commodities like crude oil or gold, and individual stocks known for significant price fluctuations.

CFD trading can be challenging due to factors such as market volatility, leverage, and the need for disciplined risk management. Additionally, traders must contend with emotions such as fear and greed, which can influence decision-making and lead to losses if not managed effectively.

The decision to trade CFDs or stocks depends on individual preferences, risk tolerance, and trading goals. CFDs offer advantages such as leverage and the ability to profit from both rising and falling markets, while stock trading provides ownership in a company and potential dividends. It’s essential to research both options and consider factors like market conditions and personal financial situation before deciding which to trade.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.