-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

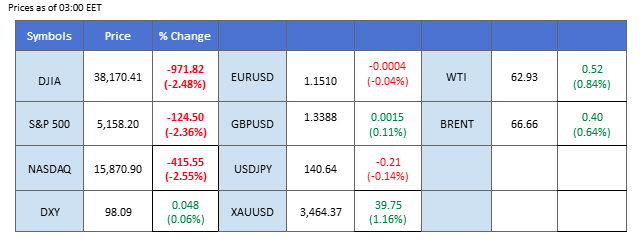

Market Summary

Global financial markets remained on edge as political tensions in the U.S. intensified, with President Donald Trump renewing pressure on the Federal Reserve to cut interest rates. Trump’s calls for policy easing come amid his assertion that inflation shows no signs of rebounding — a stance at odds with the Fed’s own assessment, as the central bank’s preferred inflation gauge remains short of its 2% target.

The divergence between political expectations and monetary policy outlook has spooked investors, triggering a sharp sell-off on Wall Street, with major indices retreating from recent highs. Meanwhile, the U.S. dollar remained under pressure, with the Dollar Index (DXY) hovering below the 99.00 mark, reflecting fading confidence in the greenback.

In contrast, safe-haven assets continued to shine. Gold prices surged to a fresh all-time high, now edging closer to the critical $3,500 level, driven by risk aversion and declining real yields. The Japanese Yen and Swiss Franc also strengthened, underscoring investors’ flight to safety.

Adding to the momentum, Bitcoin (BTC) extended its rally, reaching its highest level in April. The weakening dollar, combined with the equity market rout, has redirected capital toward decentralized digital assets, with BTC increasingly viewed as an alternative hedge amid macroeconomic instability.

As markets await further clarity on Fed policy and political developments in Washington, volatility is likely to remain elevated, with safe-havens and digital assets continuing to draw inflows.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.9%) VS -25 bps (9.1%)

Market Overview

Economic Calendar

(MT4 System Time)

N/A

Source: MQL5

Market Movements

The US Dollar Index, which measures the greenback against a basket of six major currencies, continued to decline as President Donald Trump ramped up pressure on Federal Reserve Chair Jerome Powell to cut interest rates immediately. Trump warned that the US economy could slow down unless rates are lowered soon, while Powell maintained that rate adjustments should be based on inflation and economic data. Lower interest rates typically weigh on the dollar, as they reduce the currency’s yield appeal to global investors.

The Dollar Index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 27, suggesting the index might enter oversold territory.

Resistance level: 100.00, 102.65

Support level: 96.70, 92.95

Amid ongoing global economic uncertainty and trade war risks, gold prices surged to another record high. Fears that tariffs could lead to higher inflation have strengthened gold’s appeal as a safe-haven asset. Additionally, the Fed’s potential shift towards expansionary monetary policy—under political pressure from Trump—has triggered aggressive dollar selloffs, further boosting gold prices. With the current macroeconomic backdrop, gold could continue its bullish momentum.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 85, suggesting the commodity might enter overbought territory.

Resistance level: 3475.00, 3525.00

Support level: 3365.00, 3280.00

The GBP/USD pair is approaching a critical resistance level at 1.3415, its highest mark since September, with a potential breakout paving the way toward a three-year high. Sterling’s momentum has been largely fueled by broad-based weakness in the U.S. dollar, which continues to suffer from political turmoil in Washington. The growing rift between President Trump and Federal Reserve Chair Jerome Powell has rattled investor confidence, casting doubt over the central bank’s independence and policy direction. This latest episode of political instability has dented the greenback’s appeal, allowing major counterparts like the pound to capitalize. If GBP/USD successfully breaches the 1.3415 level, it could trigger further bullish momentum.

The pair remains hovering above its fair-value gap and is testing its critical resistance level at the 1.3415 mark. A break above this level indicates a solid bullish signal for the pair. The RSI remains in the overbought zone, while the MACD remains at an elevated level, suggesting that the bullish momentum remains intact with the pair.

Resistance level: 1.3415, 1.3505

Support level: 1.3340, 1.3270

The Swiss Franc extended its bullish run, reaching its strongest level against G7 peers since 2011, reaffirming its position as a traditional safe-haven asset amid growing market unease. In the latest session, the USD/CHF pair broke decisively below its recent sideways range, signaling a bearish technical breakout and reinforcing the downward trajectory of the pair. The move comes as political instability in the U.S. deepens, with the standoff between President Trump and Federal Reserve Chair Jerome Powell shaking investor confidence. The escalating tension over monetary policy independence has cast a shadow over the U.S. dollar, which continues to lose ground.

The pair has reaffirmed its bearish trend after breaking below the sideway range in the last session. The RSI remains below the 50 level, while the MACD fails to break above the zero line, suggesting that the bearish momentum is overwhelming.

Resistance level: 0.8220, 0.8400

Support level: 0.8035, 0.7875

The US stock market closed lower, dragged down by renewed political pressure on the Fed and escalating concerns over economic stability. Trump’s aggressive remarks targeting Fed Chair Jerome Powell spooked investors, especially when combined with lingering trade war tensions. The upcoming corporate earnings releases from major US firms may also introduce further uncertainty. Risk sentiment remains fragile, prompting broad equity selloffs.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 36, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 40595.00, 42730.00

Support level: 37825.00, 35305.00

The USD/JPY pair extended its downward slide, hitting fresh lows and is now testing the critical psychological support at the 140.00 mark. A confirmed break below this level would likely serve as a strong bearish signal, potentially driving the pair lower in the near term. The pair’s movement is largely driven by the prevailing risk-off sentiment across global markets, prompting investors to rotate into traditional safe-haven assets such as the Japanese Yen. Adding to the Yen’s appeal, the upcoming Japanese CPI data, scheduled for release later today, is expected to show a rise in inflation compared to the previous reading. A hot CPI print could further bolster expectations of policy normalization from the Bank of Japan, providing additional fuel for Yen’s strength and reinforcing the downward bias for USD/JPY.

USD/JPY is testing its critical support level at 140.00. A break below this level could be a solid bearish signal for the pair. The RSI has broken into the oversold zone, while the MACD has been hovering below the zero line, suggesting that bearish momentum is prevailing.

Resistance level: 143.95, 147.15

Support level: 137.45, 135.00

Oil prices bounced slightly after testing support levels. Expectations of lower US interest rates continue to undermine the dollar, indirectly supporting dollar-denominated commodities like oil. Traders are also monitoring US-Iran nuclear deal negotiations, with any progress likely to impact Iranian oil supply. Additionally, the ongoing trade war remains a critical factor influencing global oil demand and sentiment.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 56, suggesting the commodity might extend tis gains since the RSI stays above the midline.

Resistance level: 65.40, 68.55

Support level: 62.25, 59..95

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!