-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

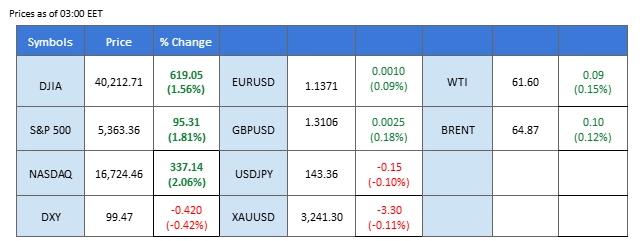

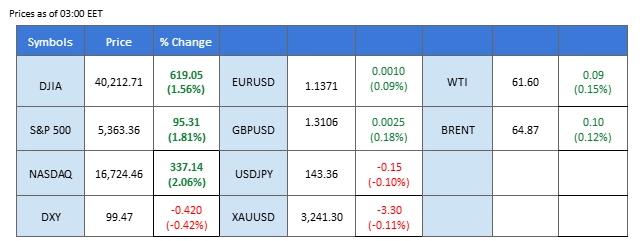

Market Summary

Markets are grappling with renewed pressure as the U.S.-China trade tensions intensify. Washington’s decision to hike tariffs on Chinese goods to 145% triggered an immediate response from Beijing, which imposed a 125% levy on American imports. The tit-for-tat escalation has deepened fears of a prolonged trade war, driving global risk-off sentiment. Confusion over electronics exemptions added to market anxiety, with President Trump asserting that products like smartphones and laptops remain under a 20% fentanyl-related tariff—despite Customs clarifying that several tech items, including semiconductors, are temporarily excluded.

However, uncertainty persists, as the White House signaled upcoming national security measures that may re-target the electronics supply chain. Commerce Secretary Howard Lutnick confirmed that new tariffs, particularly on semiconductors, could be implemented within a month, clouding the outlook for tech firms heavily reliant on Chinese manufacturing. The U.S. Dollar Index slumped after a 90-day tariff pause was granted to non-retaliatory nations, excluding China—an erratic move that further eroded confidence in the administration’s trade strategy.

In response to the escalating tensions, safe-haven assets surged. Gold hit multi-year highs, while the Japanese Yen and Swiss Franc gained sharply. Meanwhile, U.S. equities remained volatile, with the S&P 500 down over 10% year-to-date. Tech stocks like Apple and Nvidia saw brief rallies on limited tariff relief, but optimism faded as policy uncertainty lingered.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85%) VS -25 bps (15%)

Market Overview

Economic Calendar

(MT4 System Time)

N/A

Source: MQL5

Market Movements

The U.S. Dollar Index continued its downward trend, pressured by mounting fears of a prolonged trade war and recession risks after President Donald Trump hiked tariffs on China to a record 125%. While China has yet to issue a formal response, markets remain on edge, with investors closely watching for any retaliatory action that could further escalate tensions and weigh on economic growth.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 102.95, 106.80

Support level: 99.65, 95.85

Gold prices extended their gains, supported by escalating U.S.-China trade tensions and a weaker-than-expected U.S. CPI report. As the U.S. announced a fresh 145% tariff hike on China, investor demand for safe-haven assets increased. With China yet to respond, markets await a potential bilateral trade meeting this week, which could influence the next leg of gold’s move.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 3225.00, 3295.00

Support level: 3170.00, 3130.00

The British pound climbed sharply against the U.S. dollar , as a combination of dollar weakness, strong UK data. The U.S. Dollar Index (DXY) fell to a nine-month low following weaker-than-expected inflation prints—PPI dropped 0.4% MoM and CPI slowed to 2.4% YoY—boosting market expectations for Federal Reserve rate cuts.. Meanwhile, the UK economy delivered a surprise 0.5% MoM GDP gain in February, driven by robust manufacturing and services output. However, upside risks are tempered by expectations for Bank of England rate cuts, with markets pricing in 85 bps of easing by year-end. Additionally, erratic U.S. tariff policy may generate volatility that limits Sterling’s advance.

GBP/USD is currently trading near 1.3090 after a strong rally from the 1.2695 support zone, having broken through multiple resistance levels with bullish momentum. The RSI stands at 66, signaling healthy upside momentum without being overbought while the MACD line has crossed above the signal line with a growing histogram, reinforcing bullish sentiment and suggesting continued upside in the near term.

Resistance level: 1.3090, 1.3175

Support level: 1.2945, 1.2850

The euro rebounded, buoyed by the Trump administration’s decision to pause tariffs on the European Union. The European Commission stated it will assess the state of trade relations carefully, while member states have approved proposals to prepare potential countermeasures against the U.S., maintaining a cautious yet strategic stance.

EUR//USD is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 59, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.1430, 1.1540

Support level: 1.1285, 1.1190

Oil prices rebounded slightly, driven mostly by a technical correction, though the broader sentiment remains bearish. Heightened global trade tensions have dimmed demand prospects for oil, while recession fears grow amid persistent tariff escalations. Economists caution that a prolonged trade war could significantly impact global growth, further dampening long-term demand for crude.

Crude oil prices are trading higher following prior rebounded from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 52, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 62.75, 66.20

Support level: 59.15, 56.65

The Japanese yen extended its gains, with USD/JPY falling amid a stronger-than-expected producer inflation report from Japan. This bolstered expectations of continued monetary tightening by the Bank of Japan, with Governor Kazuo Ueda reaffirming the BOJ’s commitment to its rate-hike path despite global trade headwinds. The pair remains under pressure as investors digest the BOJ’s hawkish tone.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 144.15, 147.40

Support level: 140.65, 137.45

The U.S. equity market faces renewed headwinds after President Trump denied exemptions for electronic products from his latest round of tariffs. In a Truth Social post, Trump confirmed that smartphones and laptops will remain subject to a 20% fentanyl-related tariff, contradicting earlier reports. This heightened concerns for major tech firms like Apple (NASDAQ: AAPL), which rely heavily on Chinese manufacturing. The announcement comes on the heels of an even broader 145% tariff rollout on Chinese goods earlier this month.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 45, suggesting the index might extend its gains since the RSI rebounded from oversold territory.

Resistance level: 18855.00, 19500.00

Support level: 18060.00, 17440.00

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

Markets are grappling with renewed pressure as the U.S.-China trade tensions intensify. Washington’s decision to hike tariffs on Chinese goods to 145% triggered an immediate response from Beijing, which imposed a 125% levy on American imports. The tit-for-tat escalation has deepened fears of a prolonged trade war, driving global risk-off sentiment. Confusion over electronics exemptions added to market anxiety, with President Trump asserting that products like smartphones and laptops remain under a 20% fentanyl-related tariff—despite Customs clarifying that several tech items, including semiconductors, are temporarily excluded.

However, uncertainty persists, as the White House signaled upcoming national security measures that may re-target the electronics supply chain. Commerce Secretary Howard Lutnick confirmed that new tariffs, particularly on semiconductors, could be implemented within a month, clouding the outlook for tech firms heavily reliant on Chinese manufacturing. The U.S. Dollar Index slumped after a 90-day tariff pause was granted to non-retaliatory nations, excluding China—an erratic move that further eroded confidence in the administration’s trade strategy.

In response to the escalating tensions, safe-haven assets surged. Gold hit multi-year highs, while the Japanese Yen and Swiss Franc gained sharply. Meanwhile, U.S. equities remained volatile, with the S&P 500 down over 10% year-to-date. Tech stocks like Apple and Nvidia saw brief rallies on limited tariff relief, but optimism faded as policy uncertainty lingered.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85%) VS -25 bps (15%)

Market Overview

Economic Calendar

(MT4 System Time)

N/A

Source: MQL5

Market Movements

The U.S. Dollar Index continued its downward trend, pressured by mounting fears of a prolonged trade war and recession risks after President Donald Trump hiked tariffs on China to a record 125%. While China has yet to issue a formal response, markets remain on edge, with investors closely watching for any retaliatory action that could further escalate tensions and weigh on economic growth.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 102.95, 106.80

Support level: 99.65, 95.85

Gold prices extended their gains, supported by escalating U.S.-China trade tensions and a weaker-than-expected U.S. CPI report. As the U.S. announced a fresh 145% tariff hike on China, investor demand for safe-haven assets increased. With China yet to respond, markets await a potential bilateral trade meeting this week, which could influence the next leg of gold’s move.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the commodity might enter overbought territory.

Resistance level: 3225.00, 3295.00

Support level: 3170.00, 3130.00

The British pound climbed sharply against the U.S. dollar , as a combination of dollar weakness, strong UK data. The U.S. Dollar Index (DXY) fell to a nine-month low following weaker-than-expected inflation prints—PPI dropped 0.4% MoM and CPI slowed to 2.4% YoY—boosting market expectations for Federal Reserve rate cuts.. Meanwhile, the UK economy delivered a surprise 0.5% MoM GDP gain in February, driven by robust manufacturing and services output. However, upside risks are tempered by expectations for Bank of England rate cuts, with markets pricing in 85 bps of easing by year-end. Additionally, erratic U.S. tariff policy may generate volatility that limits Sterling’s advance.

GBP/USD is currently trading near 1.3090 after a strong rally from the 1.2695 support zone, having broken through multiple resistance levels with bullish momentum. The RSI stands at 66, signaling healthy upside momentum without being overbought while the MACD line has crossed above the signal line with a growing histogram, reinforcing bullish sentiment and suggesting continued upside in the near term.

Resistance level: 1.3090, 1.3175

Support level: 1.2945, 1.2850

The euro rebounded, buoyed by the Trump administration’s decision to pause tariffs on the European Union. The European Commission stated it will assess the state of trade relations carefully, while member states have approved proposals to prepare potential countermeasures against the U.S., maintaining a cautious yet strategic stance.

EUR//USD is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 59, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.1430, 1.1540

Support level: 1.1285, 1.1190

Oil prices rebounded slightly, driven mostly by a technical correction, though the broader sentiment remains bearish. Heightened global trade tensions have dimmed demand prospects for oil, while recession fears grow amid persistent tariff escalations. Economists caution that a prolonged trade war could significantly impact global growth, further dampening long-term demand for crude.

Crude oil prices are trading higher following prior rebounded from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 52, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 62.75, 66.20

Support level: 59.15, 56.65

The Japanese yen extended its gains, with USD/JPY falling amid a stronger-than-expected producer inflation report from Japan. This bolstered expectations of continued monetary tightening by the Bank of Japan, with Governor Kazuo Ueda reaffirming the BOJ’s commitment to its rate-hike path despite global trade headwinds. The pair remains under pressure as investors digest the BOJ’s hawkish tone.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 144.15, 147.40

Support level: 140.65, 137.45

The U.S. equity market faces renewed headwinds after President Trump denied exemptions for electronic products from his latest round of tariffs. In a Truth Social post, Trump confirmed that smartphones and laptops will remain subject to a 20% fentanyl-related tariff, contradicting earlier reports. This heightened concerns for major tech firms like Apple (NASDAQ: AAPL), which rely heavily on Chinese manufacturing. The announcement comes on the heels of an even broader 145% tariff rollout on Chinese goods earlier this month.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 45, suggesting the index might extend its gains since the RSI rebounded from oversold territory.

Resistance level: 18855.00, 19500.00

Support level: 18060.00, 17440.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.