-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

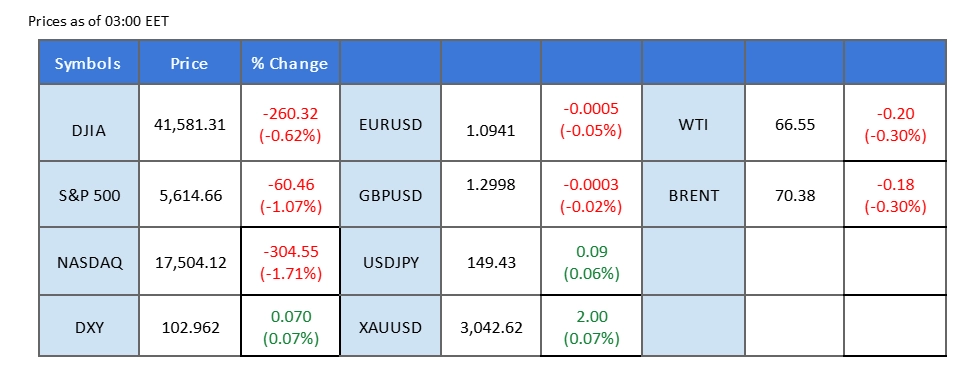

Market Summary

The market’s attention is fully locked on today’s FOMC rate decision, with expectations firmly leaning toward the Fed keeping rates unchanged. However, traders are more focused on Fed Chair Jerome Powell’s post-decision remarks for any hints on future policy direction. The dollar remains fragile, hovering near its recent lows as dovish expectations continue to weigh on the greenback.

Wall Street, which had enjoyed a two-session rally, reversed course in the last session, with all three major indices closing lower amid heightened uncertainty ahead of the Fed’s announcement. Meanwhile, the Bank of Japan held its interest rate steady, reinforcing its dovish stance. This decision weakened the Japanese yen but provided a boost to the Nikkei, which edged higher in response to the continued accommodative policy.

With multiple central bank decisions in focus and geopolitical tensions in the Red Sea still a concern, gold surged to a fresh all-time high above $3,030, reflecting strong demand for safe-haven assets. Conversely, oil prices slid by more than 1% in the last session after the market perceived easing geopolitical risks in Europe. Russian President Vladimir Putin reportedly agreed in a phone call with the U.S. President to a ceasefire deal with Ukraine, easing concerns of further escalation in the region.

In the forex market, aside from the Fed’s decision, euro traders are also closely monitoring the upcoming eurozone CPI release. Should the inflation print exceed market expectations, it could fuel further upside momentum for the euro, strengthening its position against the dollar.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index remains flat as traders await the FOMC decision. The Fed is widely expected to hold rates steady at 4.25%-4.5%, maintaining a wait-and-see approach amid policy uncertainties under US President Donald Trump. With limited US catalysts, investors will focus on the Fed’s policy statement for hints about future monetary policy direction.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 28, suggesting the index might enter oversold territory.

Resistance level: 105.05, 106.25

Support level: 103.20, 101.70

Gold prices climbed as geopolitical risks escalated, following Israel’s airstrikes on Gaza despite an existing ceasefire agreement. Over 400 casualties have been reported, and efforts to extend the ceasefire have failed, with Hamas rejecting proposals from US Presidential Envoy Steve Witkoff. However, Russia-Ukraine ceasefire talks have limited gold’s upside, as Trump and Putin agreed to a temporary halt on energy infrastructure attacks, easing immediate geopolitical risks.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 77, suggesting the commodity might enter overbought territory.

Resistance level: 3035.00, 3075.00

Support level: 2990.00, 2935.00

The British pound remains resilient, supported by better-than-expected UK economic data compared to the US. Market focus now shifts to two major central bank events: the Federal Reserve decision midweek, where rates are expected to remain at 4.25%-4.5%, and the Bank of England’s (BoE) announcement on Thursday, where policymakers are expected to vote 7-to-2 in favor of holding rates at 4.5%, following last month’s rate cut. Traders will closely watch the BoE’s forward guidance for any signs of future adjustments.

Despite supportive fundamentals, technical indicators suggest potential downside risk for GBP/USD due to pre-BoE uncertainty. A bearish divergence has formed, where price action remains upward, but MACD and RSI show a downward trend. If bearish momentum continues, GBP/USD could extend losses toward the 1.2965 support level.

Resistance level: 1.3000, 1.3065

Support level: 1.2945, 1.2870

The EUR/USD pair edged higher in the last session but is now encountering strong resistance near the 1.0960 mark. A decisive break above this level, particularly after a week-long consolidation, could serve as a solid bullish signal, potentially setting the stage for further gains. The upcoming eurozone CPI release remains a key focus for euro traders. Market expectations point to a softer inflation print compared to the previous reading, which could cap the euro’s upside momentum. However, with the dollar struggling to regain strength amid dovish Fed expectations, the euro may still capitalize on a weaker greenback and push higher. Should the pair successfully breach its immediate resistance, it could open the door for a further rally toward higher price levels.

The pair remains trading with a higher-high price pattern, suggesting a bullish bias. The RSI remains close to the overbought zone, while the MACD shows signs of rebounding from above the zero line, in line with the view that the pair is trading with bullish momentum.

Resistance level: 1.1075, 1.1198

Support level: 1.8060, 1.0672

The USD/JPY has surged past the critical resistance level at 149.50, reinforcing a bullish bias for the pair. The Bank of Japan’s latest interest rate decision aligned with market expectations, opting to keep rates unchanged. This move has further weighed on the Japanese Yen, which continues to trade with a weak tone, allowing the pair to reach a fresh weekly high. With the BoJ maintaining its dovish stance amid ongoing economic uncertainties, the Yen remains vulnerable, providing room for further upside in USD/JPY. If the pair sustains momentum above the 149.50 level, a test of the psychological 150.00 mark could be the next key target for traders.

The pair has been trading in a higher-high price pattern since last week and has broken its resistance level, suggesting a bullish bias for the pair. The RSI has been moving upward, while the MACD has broken above the zero line and edged higher, suggesting that the bullish momentum has been growing.

Resistance level: 151.30, 154.00

Support level: 147.00, 143.80

The Hang Seng Index has climbed to its highest level since February 2022, reinforcing a strong bullish bias. With Wall Street facing uncertainty over Trump’s policy direction, investors are increasingly turning to the Chinese index as a relative safe haven. This shift in sentiment has propelled the Hang Seng toward its next key psychological resistance at the 25,000 mark. A breakout above this level would signal further bullish momentum, potentially extending the rally as investor confidence in Chinese equities strengthens.

The index continues to trade within its uptrend channel, suggesting a bullish bias. The RSI is once again getting into the overbought zone, while the MACD remains above the zero line, indicating that the index is still trading with bullish momentum.

Resistance level: 25670.00, 26690.00

Support level: 23770.00, 22640.00

Oil prices fell 1% on Tuesday as Trump and Putin discussed ending the Ukraine war, raising hopes of easing sanctions on Russian energy exports. A 30-day halt on attacks on energy infrastructure has alleviated supply disruption concerns. However, Trump’s aggressive trade tariffs continue to weigh on crude demand, with the OECD warning that tariffs on China, Mexico, Canada, and the EU could slow economic growth, particularly in North America.

Crude oil prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 38, suggesting the commodity might enter oversold territory.

Resistance level: 67.80, 69.05

Support level: 66.35, 65.30

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

Disclaimer

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!